The Culture of Working in Venture Capital

Three years at Antler and I realized that being an investor and someone who cares more than everyone else are pretty much the same thing.

At the earliest stage, caring deeply is the job.

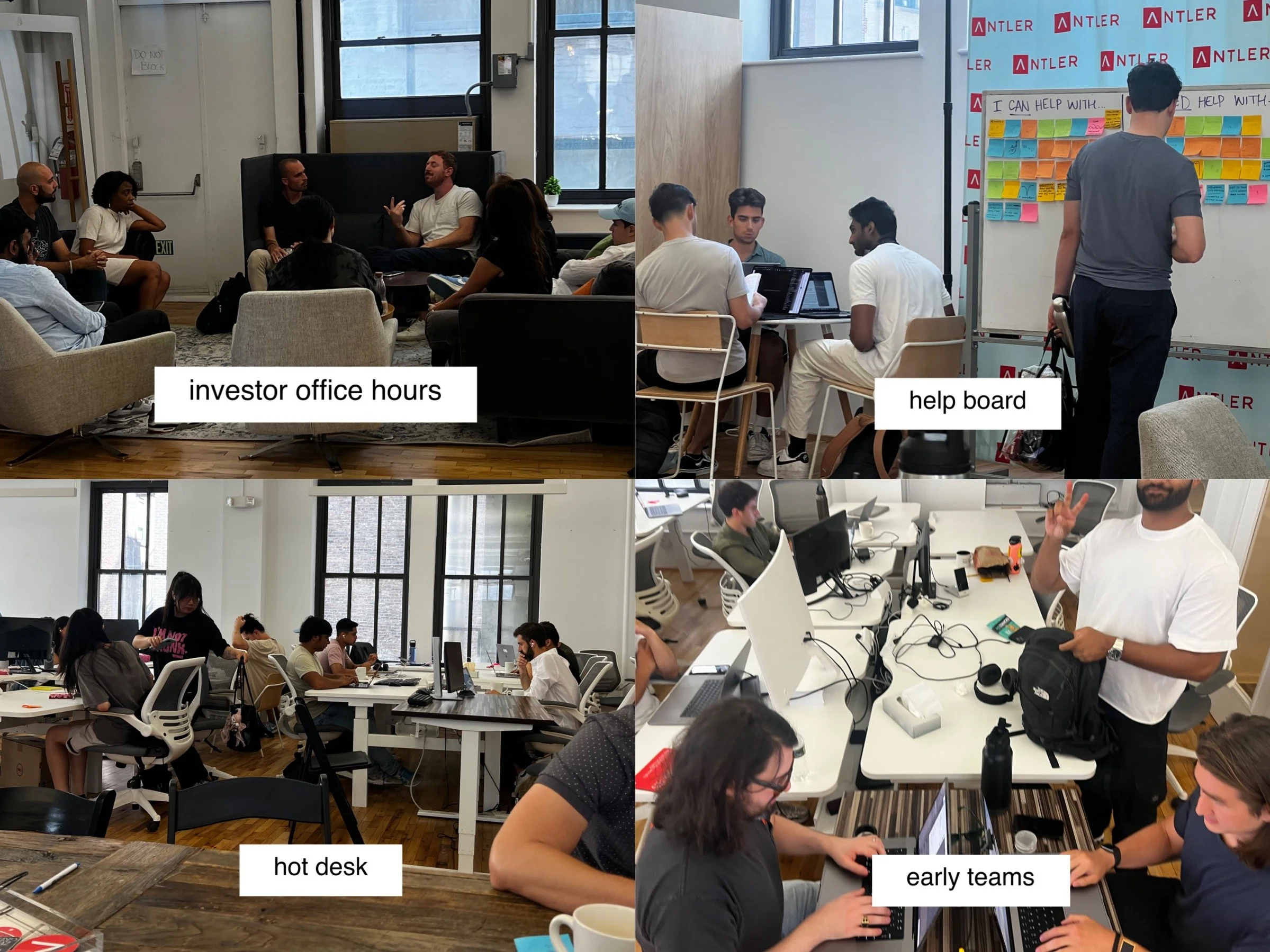

Here’s what I’ve observed and learned about building community and backing founders.

1. Spike or die

When it comes to joining the Founder Residency, having a very unique-to-you kind of spike helps. One undeniable strength matters more than being good at everything. This was a slack I read in my first week at Antler by a Partner who rejected a founder upon first meeting:

What makes you feel the most alive and ideally you’re in the top threshold in, is probably your spike. In my offer conversation, the COO and I agreed on how community building and public speaking were my unique spikes but she also saw “content” as my spike before I did. Sometimes you see people's leverage before they do. The art is naming it early so they can lean into it and since joining, I do enjoy capturing content and making videos in my free time.

I can generally spot someone’s spike in a first conversation. I’ve seen what happens when people lean into their unfair advantage vs. when they try to be well-rounded. The well-rounded ones quit and the spiky ones push on.

2. Resilience starts with the team

We fill the Founder House with 250+ new founders and host a lot of external facing events on top of that. We shake hands all the time. We share a kitchen. Falling sick, while inevitable sure, needs to be prevented. Everyone on the team has a health practice: daily morning gym, yoga, HIIT, evening sound baths, 40-hour fasting, or walking meetings only.

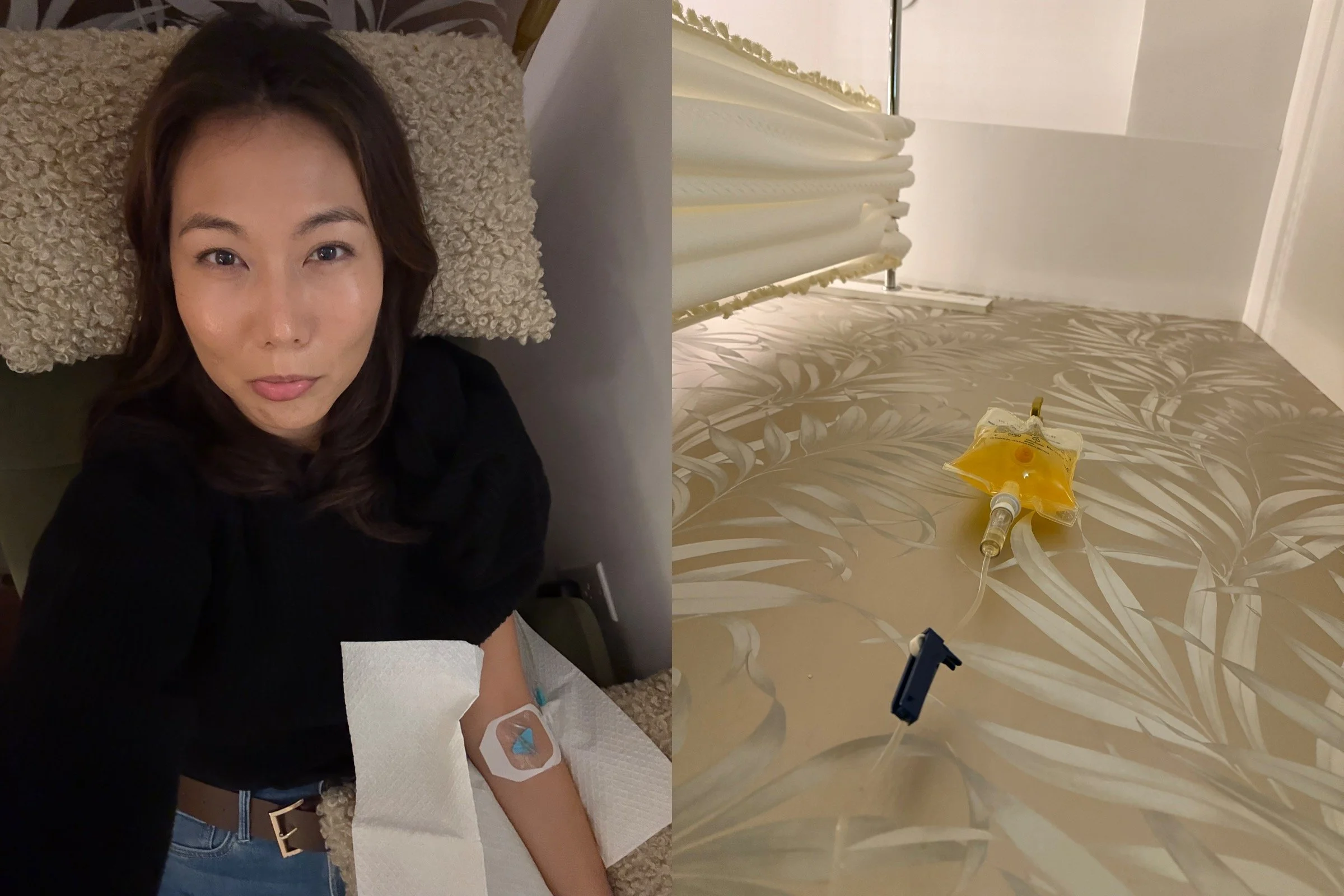

I’ve spent $600 on IV bags to avoid missing flagship events I’m running point for because the work matters too much and showing up is too important. If I could add one thing to our budget it would be a longevity coach for the whole team and founder community because we’re committed to doing this for the long haul.

3. Reading people matters more than reading decks

The number of times I hear Partners say “what I sensed…” is extraordinary. It’s used in our team recaps after they’ve met with founders, when negotiating, and essentially any business conversation.

We have always been clear that we are investing in a person’s ability to convince other people to believe in something that doesn’t exist yet. Partners can always sense if there’s a delta between what someone is saying and what they’re feeling. Intuitively so can I if I’m tuned in and that gap is where the truth is.

Being naturally intuitive is a massive gift that doesn’t get talked about enough.

4. Clarity over velocity

But on the note of words you hear all the time, something I find myself slacking a lot is: “hey - double checking - [insert my question here]”

I double check my information sometimes because a) how fast things change/new updates are uncovered and b) almost every decision I make is a collaboration so if things do change, there’s another party involved and it’s my job to keep things seamless.

Speed with incomplete information can result in expensive chaos. I’d rather slow down for 30 seconds to confirm than spend 3 weeks risking trust and cleaning up a mess that didn’t need to exist.

This doesn’t mean I’m never wrong but at least I’m never in doubt.

5. The reward for great work is more work

When you truly love the work, the reward of a thing it to have done it well.

New York is one of the highest performing Antler locations and our GP is tasked with 8 other things to do for the fund across L&D, social, and overall management. While it can feel overwhelming, a signal that you’re doing something special is getting more work and invitations for collaboration.

I get asked to mentor other operators in the UK and Australia funds. I help other locations figure out how to run their founder residencies and off-sites. I take coffees in NYC and Seoul with people trying to build what we've already built here. Every time, my first thought is still "they could have asked anyone,” then I remember they're asking because we've proven it works and I love talking about it.

I think people who get tapped for more are the ones who make the work look easy that others forget how hard it actually is. Remembering this makes me feel like a ballerina.

6. I get attached, everyone does

Every cycle, someone reminds me: don’t get emotionally attached to the founders.

I can’t even help it.

I understand why though.

Detachment protects you from disappointment.

But at the same time, early-stage investors do attach. They see potential before anyone of us.

When it comes to an investment decision, a founder meets with Antler Partners across all the locations - SF, ATX, and NYC. This gives investors who aren’t emotionally attached give a more objective take on the business and founder.

There was a founder who I was as certain we would invest in. After getting to know her, I felt like she would build a successful startup, even if she had to will it into existence— she was incredible with people and knew her tech and her network was insane. This is how I described her:

We didn’t invest. She quit before even starting and got a job in finance. I didn’t see that in the cards at all.

My thing is that I’m easily excitable and quick to get emotionally invested but now after seeing 1000+ founders pitch, you can sense conviction vs. performance in the first couple of slides.

I think everyone gets emotionally attached. The difference is whether you’re honest enough to admit it and disciplined enough to keep balanced.

an image of the team, post local investment committee, after founders finished pitching, and some will go to U.S. wide investment team to pitch or be deferred to another time but either way, it’s all hands on deck

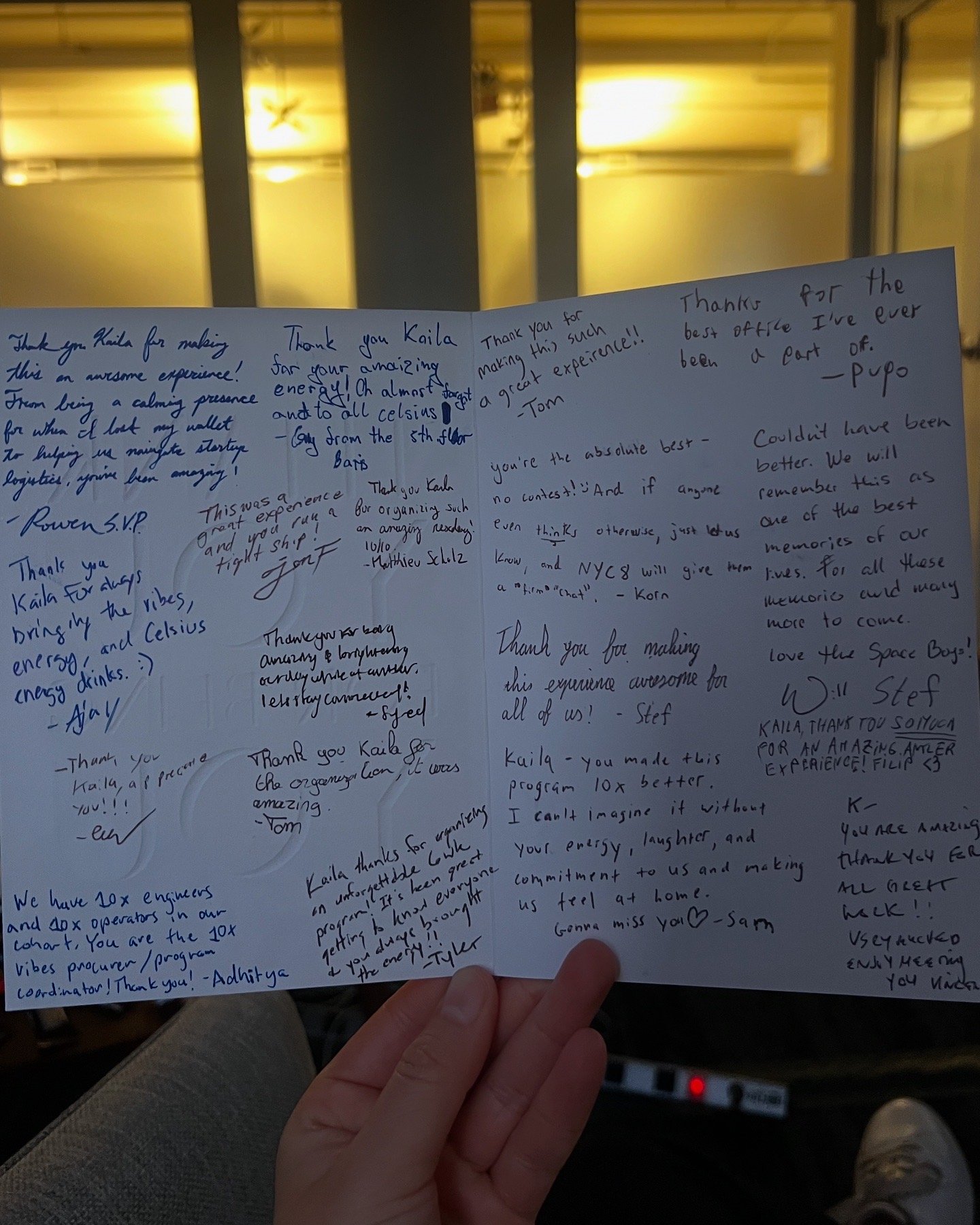

7. I’m a die hard for the try-hards

The best founders I met care with irrational intensity.

In high school, I remember it was cool to get good grades but only if you weren’t trying hard to get them. However I achieved A’s by very visibly putting in a lot of effort, adding multimedia art to poster projects, submitting extra credit, fundraising above goal and at the time, my “friends” thought I was cringe. So I tried to play it down. It took me a year to realize I just had the wrong friends.

Every founder who walks in is openly obsessed. The energy is contagious. No one’s performing casual.

I’ve built my entire career on this principle. Every community I’ve built, every event I led, every founder I advocated for, it’s all been a bet that caring deeply is a competitive advantage in a world that rewards looking like you don’t care.

a sweet slack I received from a founder that motivated me to move mountains

NYC7 founders helping us with phonebooths - the saga <3

fresh florals for our founder bouquet event with Rho and Apollo

8. Leadership in VC is personality made louder

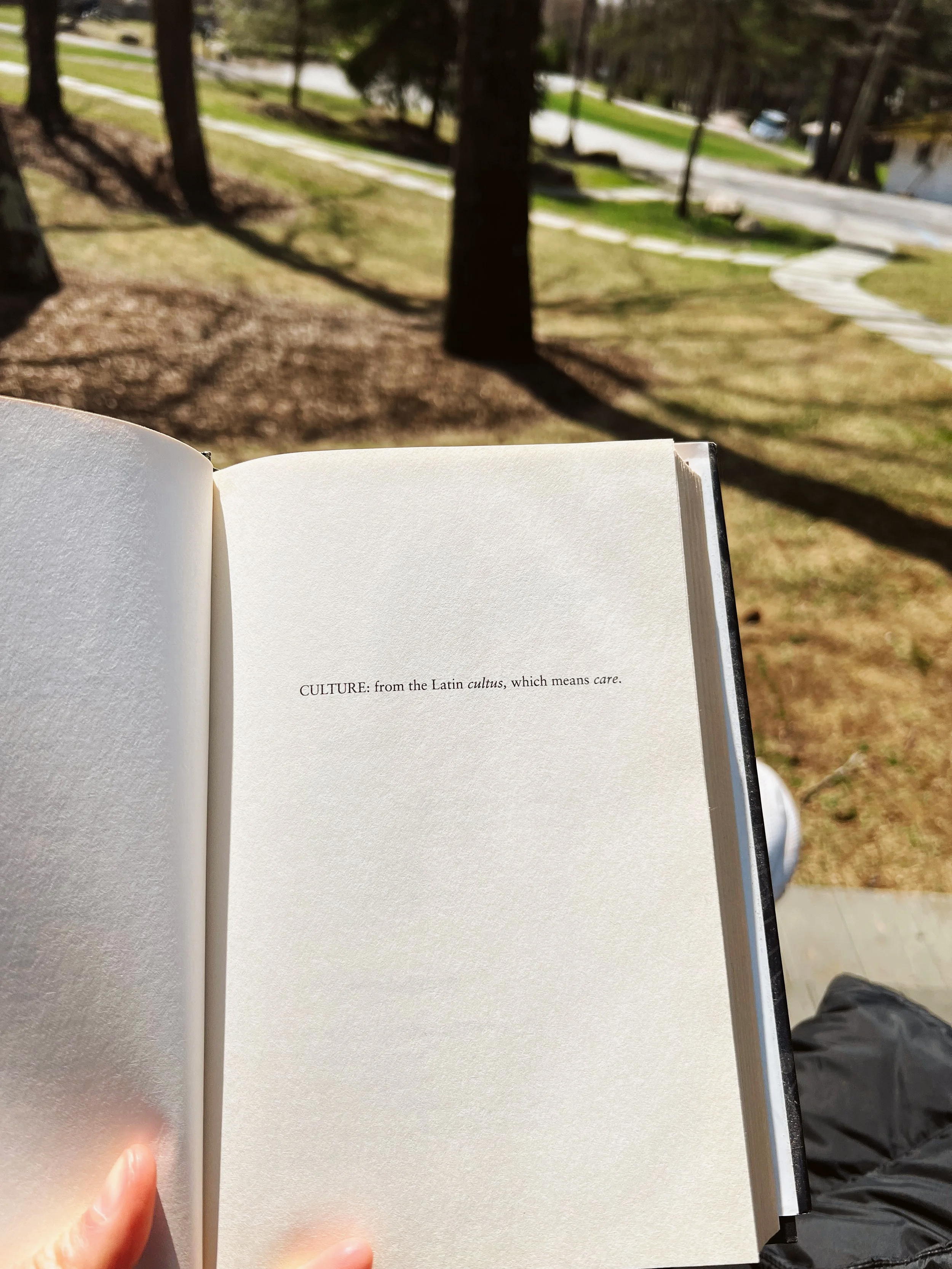

Similar to early startups, culture IS the people.

It’s unfiltered and raw.

I worked at tech companies where the Head of Culture will soften edges and manage optics. In VC, it’s real humans and all their pros and cons running the place. Luckily, Antler’s been exceptional at hiring that this creates something rare where the leadership you see in public is also who they are in private.

While culture is top down, a new hire will learn how to operate by watching their incumbent teammates. We had male investors passionate about womens health and it showed in their education and made being on the team a game changing experience for me personally.

This is something I think about a lot as I build community and design experiences for founders.

You can't manufacture culture through slides and dinners.

You build it by being the kind of person others want to be around, and then you hire more of those people.

9. Why we don’t do goodbye parties

I’m used to how at a tech startup, on someone’s last day, the company hosts a send-off party and celebrates their next play. It’s a pretty big deal of a happy hour with a calendar invite that has a massive list. Impact gets recognized, old first day stories and gratitudes are shared. People like hug and cry.

This not happening at Antler took a bit getting used to but then I figured— maybe no one does it because no one actually goes on to leave VC with the industry being so interconnected.

Here’s literally what everyone who has left gone on to do:

join a venture fund

build their own venture-backed company

And we have all stayed in touch too.

10. One stone, three birds

This mental model was indirectly taught to me by my manager and the COO of the firm. Being a lean team and having finite energy and time, it’s always worth asking the question - “how can we make the most of doing this meetup?” or “where can we add more value having already committed our resources for this project?”

One stone, three birds. One intro, four follow-ups. One investment, a dozen new founders. Early-stage venture runs on compounding relationships.

everything and more that goes down at a founder house event in NYC

Startups I worked at before prided themselves on “doing work that doesn’t scale.” VC is the opposite where we focus on things that multiply.

If I had to summarize VC in less than 5 words, it’d be: leverage, long game, and hospitality.

Companies don't see the value of community yet because they're looking for immediate ROI. The real question is: what does this unlock 6 months from now? A meetup isn't just a meetup, it's visibility, investor intros, and potential co-founders meeting each other. Every interaction is planting seeds. I'm learning to be a better gardener.

To sum it up

The best investors are the ones who can create atmospheres where caring deeply is contagious, intensity is sustainable, and everyone’s spike grows spikier.

That's what I'm building.

And I'm just getting started.

In case you missed it, I shared lessons from my first year at Antler here.